Allpuntland

Allcayn

Aminarts.com

Allmudugnews

Alcarab

Awdalnews

Allidamaale

Allwariye

Allsanaag

Agabso.com

Aflax

Allwadani

AllSomali.com

Awrboogays

Balkeena

Baydhabo Online

Bari Media

Bosaso Media

Biyokulule

Bulsho

Buruc News

Buruc Baxaya

Calanka

Ceegaag

CeegaagMedia

Cibaado

Current Analyst

Dalweyn

DissidentNation

Dowled.com

Dayniile

Dhahar.com

Dhanbaal

Doollo

GalgalaNews

Gedonet.com

Godeynews.com

Golkhatumo.com

Hadaaftimo

Halgan.net

Halganews

Hiiraan.com

HornAfrik

HorseedMedia

Jamhuuriya

Jamhuriyah

Iibka.com

Maanhadal

Mareeronews

Markacadeey.com

Markacadey.net

Miisaanka

Nomad Diaries

Puntlander

Qarannews

Qardhaawi

Raadreeb

Radio Garoowe

Radio Ogaal

Sbclive

Sheekh Umal

Shabelle

Shaaficiyah

Somalimeet

SomaliMp3

SomaliNote

Somalivoice

Somaliweyn

Somalitalk

Somaliland Org

Sanaag Post

UniversalTV

Wardheernews

Warka

Waayaha

Widhwidh

Xamuure Online

Xargaga Online

Somalia`s New Tongue Twisting Names

By Roobdoon Forum

How to Start

Your Own Xubin and Waax Country

By Roobdoon forum

Carrab Lo'aad Caws Looma Tilmaamo

By C/fataax Faamo(RF)

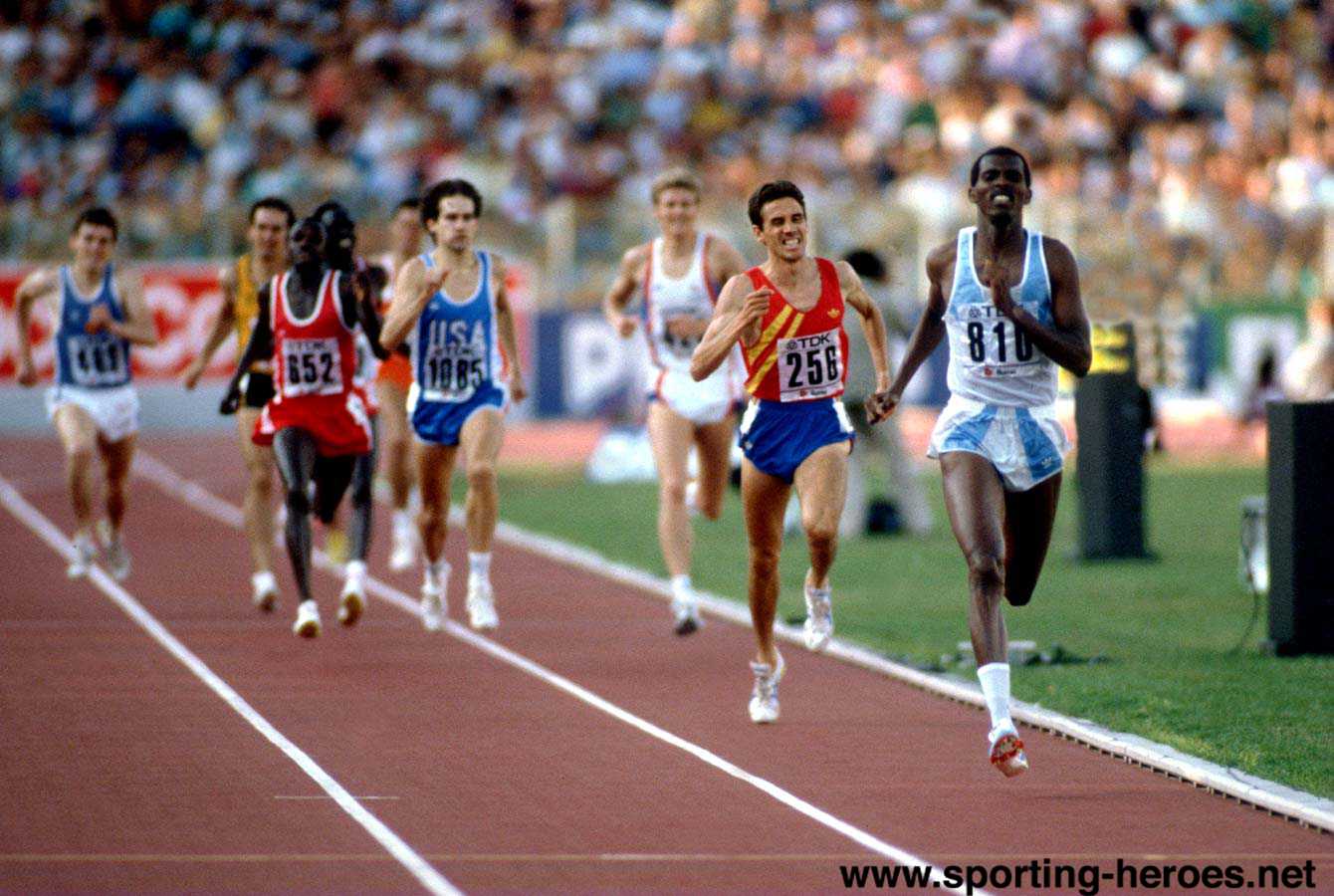

Running as a Nation Watches

Roobdoon Forum

New Beginning

in Muslim World

Islamist Vs Islamist

Hammiga Waliid & Hangoolka UNPOS

Roobdoon Forum

Puntland: A Quisling Scheme

Roobdoon Forum

.jpg)

Silsiladda Taxataran ee Beesha Axmed Harti

By M B Dubbe

Silsiladda Taxataran ee Beesha Maxamuud Harti

By M B Dubbe

|